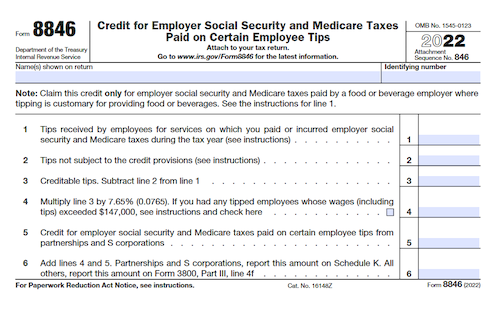

Form 8846 is an important tax document used to claim the credit for increasing research activities for the current tax year and carryforward of any unused credits from prior years. It also helps figure the amount of the credit that can be claimed.

What is Form 8846?

Form 8846 is an IRS form used to figure the tax credit for increasing research activities in a given tax year, as well as any unused credits that can be carried forward from prior years. It can be used to figure the amount of the credit claimed for the current or prior year, as well as any carryforward of unused credits from prior years. In order to accurately file, taxpayers must use Form 8846 to figure the amount of the credit that can be claimed.

IRS Form 8846 – Who Needs to Fill It Out?

IRS Form 8846 must be filled out by those looking to claim tax credits for increasing research activities in the current year, as well as carryforward any unused credits from prior years. The form allows individuals to figure the amount of the credit they can claim for the current as well as previous years, and to calculate any excess credit they may have accumulated.

Step-by-Step: Form 8846 Instructions For Filling Out the Document

Form 8846 is used to claim the credit for increasing research activities and to figure the amount that can be carried forward or claimed during the current tax year. To complete the form, the filer must provide details on the company’s research activities and any unused credit that is being carried forward from previous years. All information must be accurately provided in order for the filer to be eligible for the tax credit. Additionally, other forms such as Form 6765 and Form 3800 must be completed alongside Form 8846 in order to properly claim the credit for increasing research activities.

Below, we present a table that will help you understand how to fill out Form 8846.

| Information Required for Form 8846 | Details |

|---|---|

| Research Activities Credits | Provide details on the company’s research activities and unused credit |

| Additional Forms | Complete Form 6765 and Form 3800 alongside Form 8846 |

Do You Need to File Form 8846 Each Year?

Form 8846 is used to claim the credit for increasing research activities and to figure the amount of the credit that can be claimed for the current tax year and any carryforward of unused credits from prior years. It is important to note that the form must be filed each year in order to take advantage of any credits available, as well as to figure the amount of the credit which may be carried forward to future tax years. Therefore, it is essential that this form is filled out and filed with accuracy and in a timely manner each tax year.

Download the official IRS Form 8846 PDF

On the official IRS website, you will find a link to download Form 8846. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8846

Sources: